Enhance Your Capital Structure with Bene Sub Debt

Access flexible subordinate financing designed to complement your senior loans with Bene Sub Debt. This solution enables you to strengthen your capital base without giving up collateral, equity, or control. By integrating charitable giving within your financing strategy, you gain added built-in tax benefits while fostering positive community impact.

Bene Sub Debt Key Benefits

Up to $10 Million Funded: Secure subordinate financing tailored to your cash flow and growth goals, supporting your business and benevolent commitments.

Flexible Terms: Choose 1 to 2-year repayment terms with competitive rates starting at 15%, allowing you to balance financial needs with philanthropic initiatives.

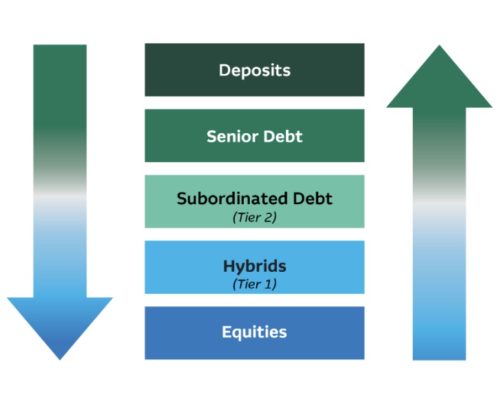

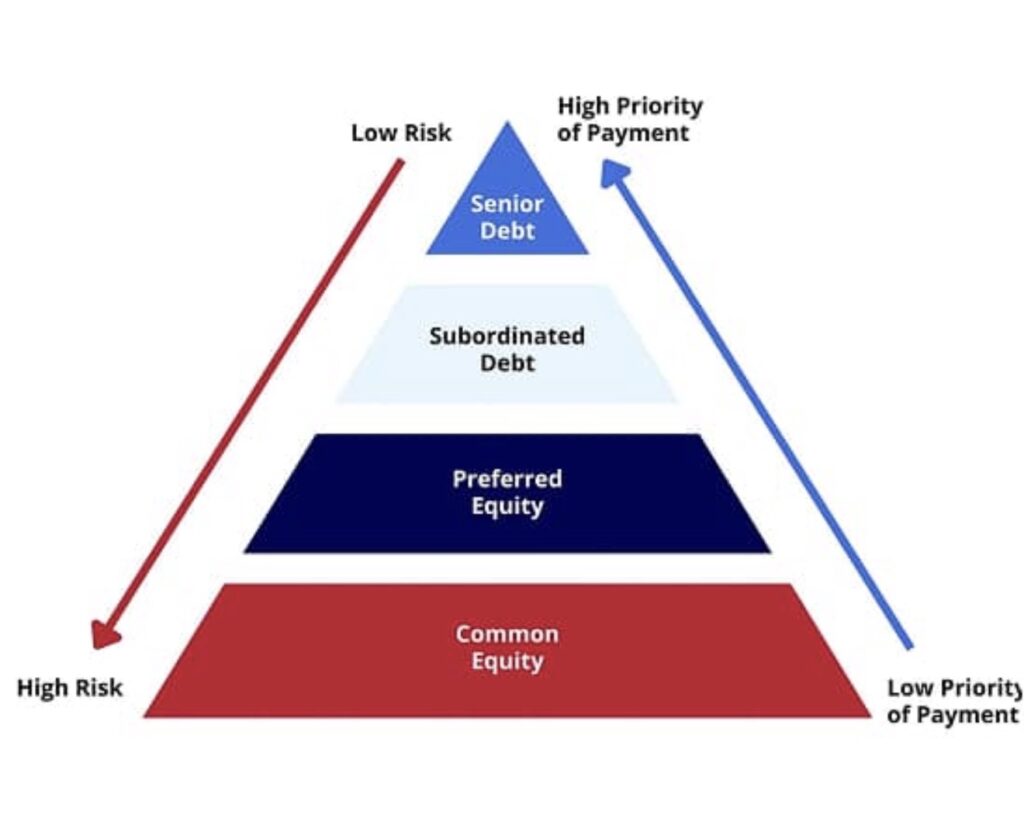

Second Lien Position: Subordinate to your senior lender, providing capital without added collateral demands or equity dilution.

No Collateral or Strings Attached: Enjoy financing free of collateral coverage, equity requirements, warrants, or restrictive covenants—empowering your growth and charitable strategy.

Who Qualifies?

- Minimum 1 year in business, demonstrating operational stability and community commitment.

- Personal credit score of 600 or higher, reflecting financial responsibility.

- At least $1 million in annual sales, supporting consistent cash flow and giving capacity.

Why Choose Bene Sub Debt?

BeneFund’s Sub Debt offering is designed for ethical, flexible financing that bolsters your capital stack while embracing social responsibility. Integrate your charitable giving with your funding strategy to realize tax efficiencies and strengthen your business’s impact in the community.