Strengthen Your Business with Bene Account Receivable Line of Credit

Unlock your business’s liquidity potential with the Bene Account Receivable Line of Credit. This flexible, revolving facility enables you to leverage your outstanding invoices to support your growth. Incorporating charitable giving into your financial strategy can also unlock built-in tax advantages while strengthening your community impact.

What Bene Offers You

Facility Size: Access between $100,000 and $100 million to fund your projects and community endeavors.

Revolving Credit: Your line of credit grows and adjusts automatically as your accounts receivable fluctuate, ensuring ongoing support for your financial needs—plus opportunities to integrate charitable contributions for tax benefits.

Competitive Rates: Starting at Prime + 2%, offering manageable costs while enabling impactful giving.

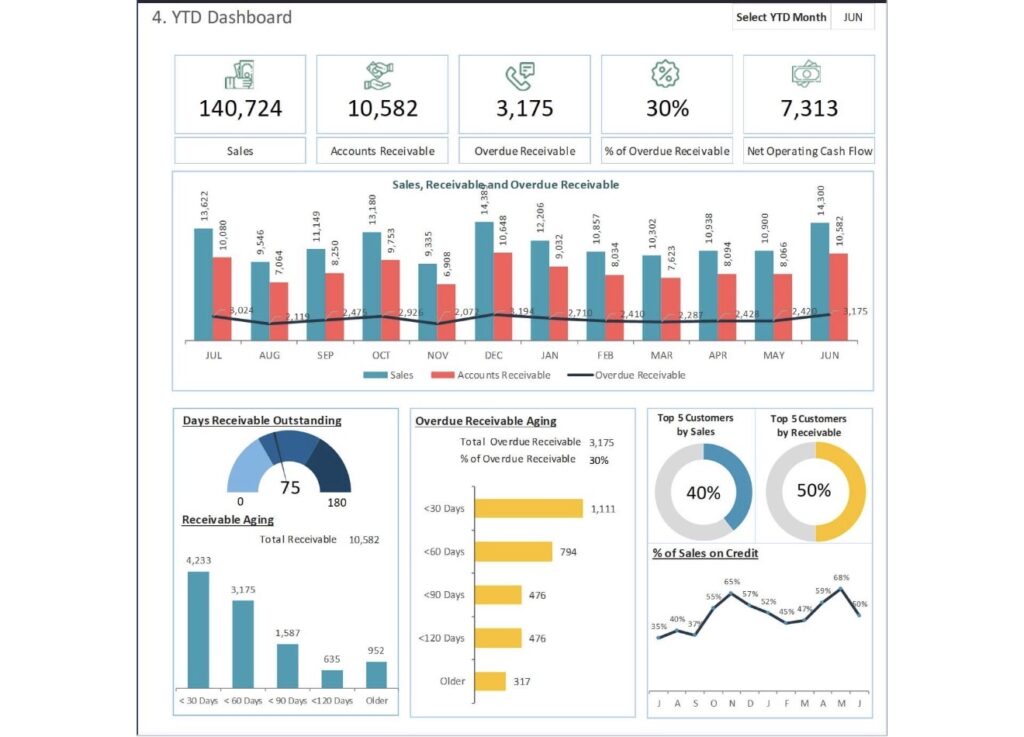

High Financing Potential: Finance up to 95% of your current accounts receivable, maximizing your cash flow and supporting your community efforts with the added benefit of potential tax savings.

Fast Funding: Typically, just 7+ days from application to receiving funds, so you can act quickly to meet opportunities and amplify your giving.

Qualification Criteria

- At least one year in business, demonstrating stability and purpose.

- No minimum FICO score required, making this accessible to most responsible businesses.

- Minimum of $1 million in annual sales.

- At least $250,000 in short-term accounts receivable, helping you manage liquidity and support charitable activities that can yield tax advantages.

Why Partner with Bene?

BeneFund’s financing solutions are rooted in ethical and community-centered principles. Our Line of Credit not only enhances your cash flow but also offers built-in benefits for charitable giving, which can provide important tax efficiencies. Grow sustainably, responsibly, and with purpose—supporting your community while strengthening your business.